CBPP Statement: January 9, 2015

For Immediate Release

Statement by Chad Stone, Chief Economist, on the December Employment Report

Todayfs jobs report shows a labor market that strengthened significantly in

2014, but one that still bears scars from the Great Recession and subsequent

federal budget cuts and other austerity policies that perpetuated a severe jobs

slump even as the economy and business profits began to recover.

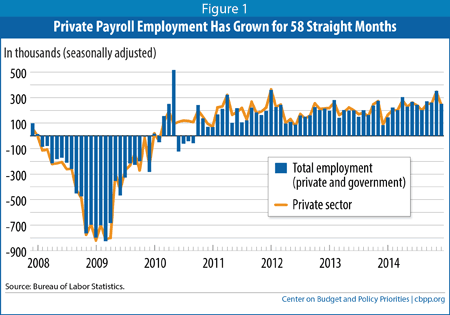

On the positive side, in 2014, the unemployment rate fell from 6.7 percent

in December 2013 to 5.6 percent in December 2014, and employers added an

average of 246,000 jobs a month (see chart). Thatfs the largest 12-month

gain in the recovery. At the same time, too many people who want a job

havenft found one, especially among the long-term unemployed. Although

unemployment fell sharply in December, for example, the labor force actually

shrank as more people dropped out than found jobs.

Private-sector employers have added jobs for 58 straight months, but for

much of that period government job losses held down overall job

creation. Last year, the huge job losses from the recession were

finally erased and government employment also began to grow modestly.

Restoring payroll employment to its pre-recession level was a milestone on the

way to a full jobs recovery, but population growth over the past several years

means the potential labor force is now larger. To restore full

employment, job creation must continue to outpace population growth.

The potential labor force includes not only people who are actively

looking for work (the unemployed) but also people who want to work but are not

actively looking because they think jobs are hard to find. The number of

such people — who are not counted in the labor force — rose sharply in the

recession and subsequent jobs slump, as did the number of people who want to

work full time but can only find part-time jobs. Similarly, the number

of long-term unemployed (jobless for 27 weeks or longer), who face greater

problems finding work than those who have been unemployed for a shorter period

— in part because of employer discrimination against the long-term unemployed —

rose sharply.

All of these indicators of labor market gslackh (people who are not working

but want to be or people who want to work full time but can only find part-time

jobs) fell in 2014. Nevertheless, they remain abnormally high. In

particular, the share of the population with a job remains near its recession

low. Thatfs why we need continued strong job creation to restore

normal labor market conditions.

Policymakers played an important role in preventing the economy from falling

into an even deeper hole in late 2008 and early 2009 when they enacted

financial stabilization measures, including TARP, and fiscal stimulus measures,

especially the American Recovery and Reinvestment Act. Subsequently,

however, their misplaced emphasis on immediate deficit-reduction rather than

additional temporary stimulus slowed the recovery. The new Congress should

recognize that the job market improvements in 2014 occurred in spite of

austerity, not because of it.

About the December Jobs Report

Employers reported strong payroll job growth in December. In the

separate household survey, the unemployment rate fell to 5.6 percent, but much

of the drop in unemployment reflected lower labor force participation rather

than an increase in the share of the population with a job.

- Private and government payrolls combined rose by 252,000 jobs in December

and the Bureau of Labor Statistics revised job growth in the previous two

months upward by a total of 50,000 jobs. Private employers added

240,000 jobs in December, while overall government employment rose by 12,000.

Federal government employment rose by 1,000, state government by 7,000,

and local government by 4,000. In 2014, federal government employment

fell by 17,000 while state government rose by 21,000 and local government

rose by 87,000, for a net increase of 91,000 government jobs.

- This is the 58th straight month of private-sector job creation, with

payrolls growing by 11.2 million jobs (a pace of 193,000 jobs a month) since

February 2010; total nonfarm employment (private plus government jobs) has

grown by 10.7 million jobs over the same period, or 184,000 a month.

Total government jobs fell by 523,000 over this period, dominated by a

loss of 309,000 local government jobs. As noted, however, local

government employment grew by 87,000 in 2014.

- The job losses incurred in the Great Recession have been erased.

There are now 2.4 million more jobs on private payrolls and 2.0 million more

jobs on total payrolls than at the start of the recession in December

2007. Because the working-age population has grown since then, however,

the number of jobs remains well short of what is needed to restore full

employment. Employers have expanded their payrolls at a 246,000-a-month

pace this year, and such growth must continue to restore normal labor market

conditions in a reasonable period of time.

- Average hourly earnings on nonfarm payrolls fell by 5 cents in December

to $24.57. Over the last 12 months they have risen 1.7 percent.

For production and non-supervisory workers, average hourly earnings fell 6

cents to $20.68, or 1.6 percent higher than a year earlier.

- The unemployment rate fell to 5.6 percent in December, and 8.7 million

people were unemployed. The unemployment rate was 4.8 percent for

whites (0.4 percentage points higher than at the start of the recession),

10.4 percent for African Americans (1.4 percentage points higher than at the

start of the recession), and 6.5 percent for Hispanics or Latinos (0.2

percentage points higher than at the start of the recession).

- The recession drove many people out of the labor force, and the ongoing

lack of job opportunities has kept many potential jobseekers on the sidelines

and not counted in the official unemployment rate. In December, the

number of unemployed fell by 383,000 but the number of people with a job rose

by just 111,000. The difference was a reduction in the labor force of

273,000. These data come from a separate survey from the data on

payroll employment and typically show much greater volatility

month-to-month.

- The labor force participation rate (the share of the population aged 16

and over in the labor force) edged down to 62.7 percent in December, about

the same as the 62.8 percent a year earlier. The sharp decline in

labor force participation during the recovery appears over, but prior to

recent years, the labor force participation rate hasnft been this low since

the 1970s. Decemberfs rate is among the lowest since 1978.

- The share of the population with a job, which plummeted in the recession

from 62.7 percent in December 2007 to levels last seen in the mid-1980s and

has remained below 60 percent since early 2009, remained 59.2 percent in

December. It was 58.6 percent a year ago.

- The Labor Departmentfs most comprehensive alternative unemployment rate

measure — which includes people who want to work but are discouraged from

looking (those marginally attached to the labor force) and people working

part time because they canft find full-time jobs — edged down to 11.2 percent

in December. Thatfs well down from its all-time high of 17.2 percent in

April 2010 (in data that go back to 1994) but still 2.4 percentage points

higher than at the start of the recession. By that measure, about 18

million people are unemployed or underemployed. The rate was 13.1

percent a year ago (about 21 million people).

- Long-term unemployment remains a significant concern. More than

three in ten (31.9 percent) of the 8.7 million people who are unemployed — 2.8

million people — have been looking for work for 27 weeks or longer.

These long-term unemployed represent 1.8 percent of the labor force.

These figures were 37.3 percent and 2.5 percent a year ago.

Before this recession, the previous highs for these statistics over the past

six decades were 26.0 percent and 2.6 percent, respectively, in June 1983,

early in the recovery from the 1981-82 recession. A year after peaking

at 2.6 percent, however, the long-term unemployment rate had dropped to 1.4

percent, well below the current rate.

# # # #

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan

research organization and policy institute that conducts research and analysis

on a range of government policies and programs. It is supported primarily by

foundation grants.